The tightening of the H-1B visa in 2025 has made U.S. tech companies to rethink their approach to global hiring. Rather than relying solely on visa programs, companies are now proactively building global teams in countries that combine cost efficiency, deep engineering talent, and favorable visa pathways.

We have analyzed 15 countries across three key dimensions:

- Cost Efficiency (50%) – Affordability of hiring and maintaining teams

- Tech Talent Availability (30%) – Strength and scalability of the local tech talent pool

- Visa Speed (20%) – Time and ease of securing work authorization for foreign workers

Sources:

- Cost Efficiency (50%): Digitalogy, Qubit-Labs, DistantJob

- Tech Talent Availability (30%): WIPO Global Innovation Index 2025, country-specific startup and outsourcing reports

- Visa Speed (20%): Canada Global Skills Strategy, Singapore Tech Pass, Germany Blue Card programs, and country-specific immigration authorities

- LATAM tech hubs: country-specific startup and outsourcing reports

This blog explores the top five countries leading the way for global tech expansion in 2026.

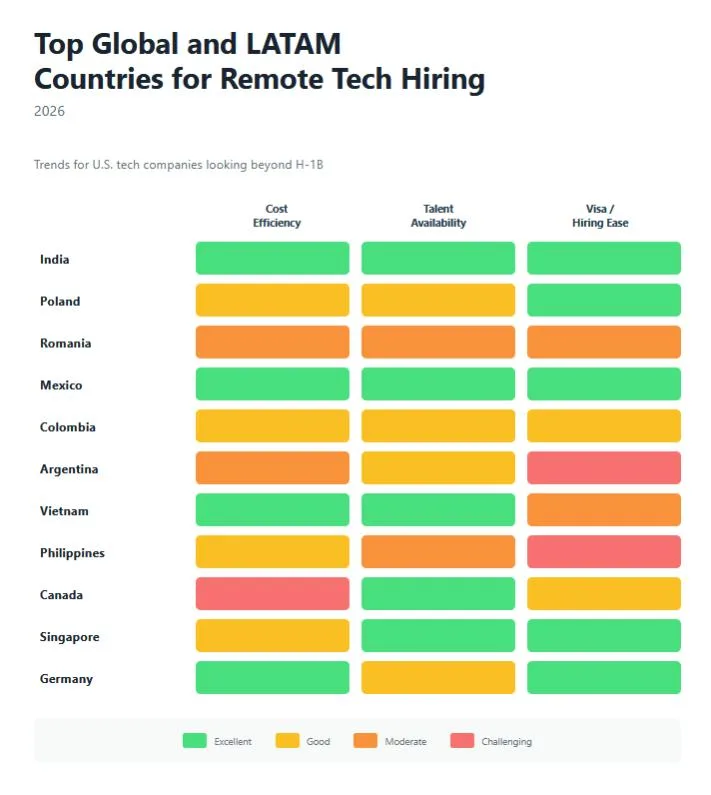

Full 2026 Country Rankings: Data-Driven Comparison

The table below shows how each country scored based on our weighted formula across cost, talent, and visa speed:

Rank | Country | Cost (50%) | Talent (30%) | Visa Speed (20%) | Weighted Score |

1 | India | 10 | 9 | 7 | 9 |

2 | Poland | 9 | 7 | 7 | 8.1 |

3 | Romania | 9 | 7 | 6 | 7.8 |

4 | Mexico | 8 | 7 | 8 | 7.5 |

5 | Philippines | 8 | 6 | 7 | 7.2 |

6 | Vietnam | 8 | 6 | 6 | 7.2 |

7 | Colombia | 8 | 7 | 7 | 7.1 |

8 | Canada | 6 | 8 | 10 | 7 |

9 | Ukraine | 10 | 7 | 6 | 7 |

10 | Germany | 5 | 8 | 8 | 6.7 |

Note: Scores are on a 1-10 scale, with 10 indicating the most favorable conditions in each category. Weighted score = 50% cost, 30% talent, 20% visa speed.

Top 5 countries for U.S. tech companies after H1B changes

Based on this weighted framework, here are the top five countries U.S. companies should prioritize in 2026 for building high-performance remote tech teams and relocating international talent.

1. India

Weighted Score: 9.0 | Rank: 1

India remains the global leader for offshore tech hiring. With the largest, most affordable English-speaking developer pool, robust IT infrastructure, and high visa accessibility, it continues to top the list for U.S. tech employers.

Why India?

- Extremely low cost with high output: Software engineers cost 60-70% less than U.S. equivalents while maintaining strong technical capabilities

- Deep engineering talent pool: Over 1.5 million STEM graduates annually, with expertise across full-stack development, AI/ML, cloud computing, and data science

- Strong infrastructure and EOR options: Mature IT services ecosystem with established legal frameworks for international hiring

- Time-tested for scale and reliability: Decades of proven success supporting Fortune 500 tech companies

Related: India Country Page

2. Poland

Weighted Score: 8.1 | Rank: 2

Poland offers a strong balance of engineering quality and affordability, particularly appealing for companies hiring in or near the EU. Its visa pathways are also relatively smooth, with a growing tech ecosystem in Kraków and Warsaw.

Why Poland?

- Competitive cost and time zone alignment: 6-7 hour overlap with U.S. East Coast enables real-time collaboration

- High level of STEM graduates: Strong educational system producing high number of IT graduates annually

- Member of the EU: Simplified mobility across borders and access to the broader European talent market

- Established outsourcing infrastructure: Mature BPO and software development centers with Western business practices

Related: Poland Country Page

3. Romania

Weighted Score: 7.8 | Rank: 3

Romania is an increasingly strategic destination for nearshore and offshore development. With low costs, solid visa pathways, and skilled engineers, Romania is ideal for both product and support engineering teams.

Why Romania?

- Low cost + EU-aligned legal systems: Combines affordability with European regulatory standards

- Strong tech hubs in Bucharest and Cluj-Napoca: Growing startup scenes and established software development centers

- Developers skilled in DevOps, security, and full-stack development: Particularly strong in Java, .NET, Python, and cybersecurity

- Cultural compatibility: Strong work ethic and alignment with Western business practices

4. Mexico

Weighted Score: 7.5 | Rank: 4

Mexico continues to dominate LATAM as the best nearshore option for U.S. companies. Offering favorable visa rules, proximity to the U.S., and a growing tech workforce, Mexico is a strong alternative to more volatile LATAM countries.

Why Mexico?

- Visa speed and talent availability are both strong: Streamlined immigration processes and expanding tech education programs

- Time zone overlap with U.S.: Real-time collaboration across all U.S. time zones

- Mature BPO and tech outsourcing infrastructure: Established centers in Mexico City, Guadalajara, and Monterrey

- Cultural and geographic proximity: Easy travel, cultural alignment, and USMCA trade benefits

Related: Mexico Country Page

5. Philippines

Weighted Score: 7.2 | Rank: 5

The Philippines is an increasingly attractive destination for U.S. tech companies seeking affordable, English-speaking engineering talent. With strong cultural alignment, a history of collaboration with U.S. firms, and growing investment in its tech sector, the Philippines is emerging as a key player in offshore software development and IT support.

Why Philippines?

- High English fluency and strong cultural fit with U.S. teams: American cultural influence and neutral accent make communication seamless

- Competitive labor costs: 65-75% cost savings compared to U.S. salaries with growing technical capabilities

- Government-supported STEM education and tech upskilling programs: Increasing focus on software development, mobile apps, and cloud technologies

- Established tech hubs: Manila, Cebu, and Davao host growing communities of developers and BPO centers

- 24/7 operations capability: Time zone difference allows for round-the-clock development cycles

Related: The Philippines Country Page

What U.S. Tech Companies Should Do with This Info

- Use the ranking table as a decision-framework, not a definitive ranking: each company’s context (team size, skill mix, time-zone needs) may shift priorities.

- For roles with high scale and cost sensitivity (e.g., product engineering, dev-ops), India, Poland, Romania provide strong value.

- For near-shore/U.S. time-zone sensitive collaboration, Mexico stands out.

- For roles requiring high English fluency, support operations, or 24/7 coverage, Philippines is a compelling option.

- Use entity setup or hybrid team models with care: cost savings are only sustainable if compliance, culture, retention, and integration are built in.

FAQ Section

What criteria were used to rank the top 5 countries?

The rankings were based on a weighted formula considering Cost Efficiency (50%), Tech Talent Availability (30%), and Visa Speed (20%).

Why is India ranked #1?

India offers the largest, most affordable English-speaking developer pool, robust IT infrastructure, and streamlined visa processes, making it ideal for scaling tech teams.

How does Poland compare to other EU countries?

Poland balances competitive costs, a strong tech talent pool, and EU membership benefits, including easier cross-border mobility and access to the broader European market.

What makes Mexico an attractive nearshore option?

Mexico provides time-zone alignment with the U.S., growing tech talent, favorable visa rules, and established outsourcing infrastructure, making real-time collaboration easier.

How should companies use this ranking?

Use it as a decision framework tailored to your organization’s team size, skill mix, time-zone needs, and growth strategy rather than as a one-size-fits-all ranking.

How Cerity Global Helps Navigate the New Global Hiring Landscape in 2026

Ready to expand globally in 2026?

Cerity Global helps U.S. companies build sustainable global operations through compliant entity setups. Let’s plan your 2026 hiring roadmap.